Multifamily Outlook

The multifamily sector faces tepid rent growth due to national oversupply and rising operational costs, often outpacing rent growth, though prospects may improve as demand starts to align with supply. Sustained quarters of positive net absorption and a slowdown in new projects could help balance demand and supply quicker, potentially boosting rent growth. Construction starts are predicted to fall by 45% in 2024 due to higher interest rates and costs, potentially leading to undersupply by 2026 as demand catches up. Slight improvements in cap rates suggest some relief, yet overall investment activity remains dampened. The financial appeal of renting tends to increase as home buying becomes less affordable, helping to create a sustained demand for multifamily housing.

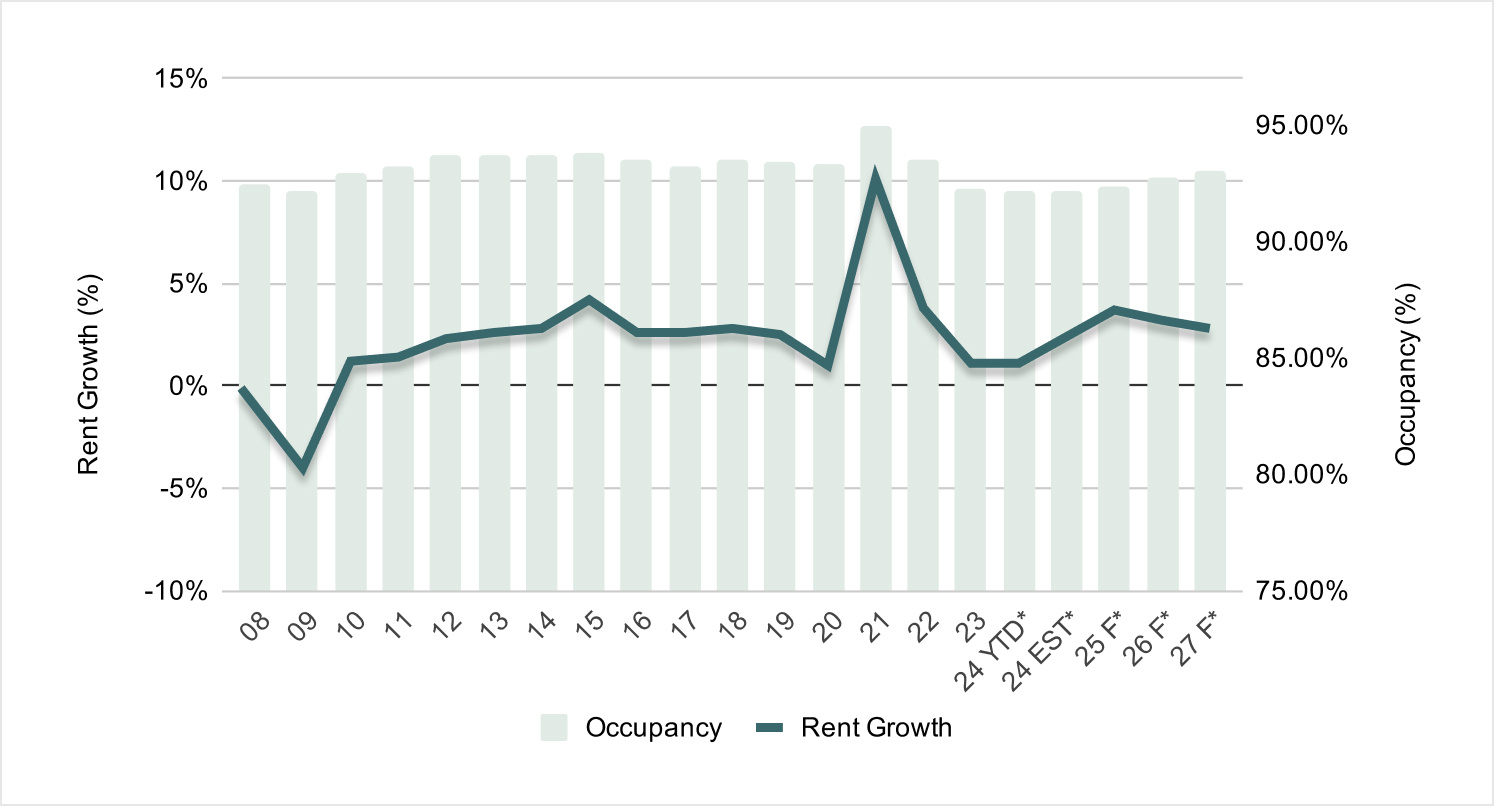

According to CoStar, the multifamily sector is experiencing tepid rent growth primarily due to a near-term oversupply.26 As corroborated by Trepp, we notice instances where expenses—such as labor costs, property taxes, and insurance—often rise more rapidly than rent growth.27 Although CoStar’s annual rent growth forecast has slightly improved to 2.5% for H2 2024, following a slow growth of 1.0% in 202326, this modest uptick in annual rent growth is unlikely to instigate a V-shaped recovery in markets burdened by oversupply. Although many CoStar markets have shifted from negative to positive territory from a rent growth standpoint26, with the notable exceptions of markets such as Austin, Tampa, and San Antonio, we still anticipate that overall rent growth for multifamily will remain subdued until supply adequately aligns with demand.

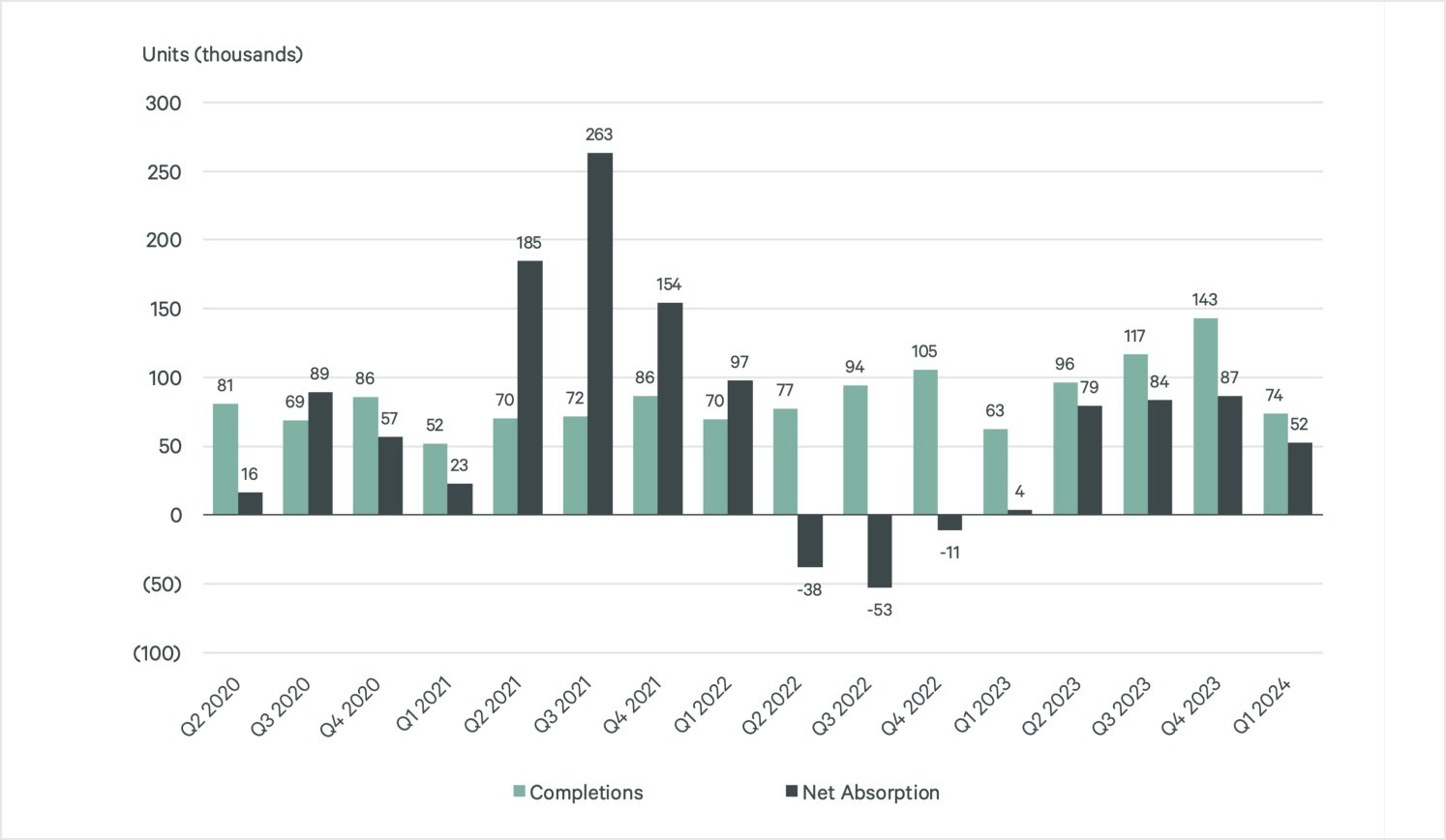

The good news is that demand is already catching up to supply—CBRE data shows multifamily net absorption has remained consistently strong this year due to sustained rental demand.28 According to CBRE’s Q1 2024 Quarterly Figures report, the year 2024 recorded one of the highest first-quarter net absorption totals in the last two decades, with 56 of 69 markets tracked by CBRE recording positive net absorption in the same quarter—an improvement after experiencing negative net annual absorption in 2023.28

Data from CBRE also indicates that the number of projects breaking ground has decreased since the rapid increase in interest rates and due to overall weakening market fundamentals, compounded by higher construction costs.28 Therefore, we expect fewer project deliveries in the near term. Paired with sustained quarters of positive net absorption, this could help stabilize the market from a supply standpoint, potentially transitioning back to a state of undersupply as demand catches up with the limited inventory available.

Affordability challenges29 in the broader housing market may enhance the financial appeal of renting by pricing out many potential home buyers. Housing demand is primarily non-discretionary, a fundamental human requirement; therefore, this can help keep demand fairly stable for the multifamily sector over the long run.

The year-over-year transaction volume for multifamily dropped significantly by 51%, reaching a level not seen since the depths of the pandemic — the decline in multifamily transaction activity was more than the 39% decline observed in the overall CRE transactions tracked by MSCI Real Capital Analytics.30

The significant slowdown in transaction activity is partly attributable to the Federal Reserve's tight lending policies, high interest rates, resulting inflated borrowing costs, rising operating expenses, and tepid rent growth.1,27 Pair that with the fact that according to Green Street, there was significant multifamily value appreciation during 2021-202223, creating discrepancies in the expectations of buyers and sellers. Sellers are generally hesitant to lower prices from their peak acquisition values, and buyers are cautious of overpaying and facing potential negative leverage scenarios.

For the market to rebound, we believe it needs to meet certain conditions: 1) A stabilization or decrease in interest rates, as hinted by 15 of 19 Fed officials post their June 12th meeting31, helping to rejuvenate financing attractiveness and capital market accessibility. 2) Economic stability and a clarified inflation outlook helping restore investor confidence. 3) A resolution in the bid-ask price gap through market corrections is necessary, helping buyers and sellers reach consensus on valuations.

According to the National Apartment Association, cap rates increased to 5.7% nationally in Q1 2024, the highest average rate seen in eight years.32 Thus, prices are beginning to adjust, and the bid-ask spread may be closing.

We believe a crucial underwriting element of discounted transactions is their ability to flip from negative to positive leverage within the first year of acquisition, assuming the asset is appropriately repriced, stabilized with strong occupancy, and exists in a primary or secondary market with above-average rent growth. We are typically considering deals for the Marketplace with unlevered yields on multifamily assets of 5% or greater or a path for the asset to achieve a 6% or greater Yield-on-Cost (“YOC”) within the first year of the hold period.

To the extent owners throw in the towel and transact at prices substantially below their peak, we believe this scenario may offer some acquisition opportunities. According to Colliers and Mortgage Bankers Association, substantial debt is maturing this year amidst expensive debt markets.33 We expect this will create an environment where operators who have been kicking the can down the road may no longer be able to do so, forcing them to sell.

A report from Urban Land Institute reveals that development deals are especially tough to pencil today, generally due to a perfect storm of tepid rent growth, higher vacancy assumptions, expensive and restrictively available construction loans, and higher construction costs.34 While we understand that locating a viable development deal in today’s environment remains challenging, we will still review such opportunities because we believe developers who can successfully break ground in today’s environment may be among the relatively few who deliver properties in the next few years. Projects delivered a few years from now may do so among a relative dearth of new supply, potentially attracting higher demand.

We also expect far greater demand for new products in the near term. Therefore, one of our strategies will be to seek newer vintage product acquisitions, meaning properties built in 2000 and after.

- CoStar, Markets, Multifamily, Data Export, July 2024. Data as of 7/16/24

- “Breaking Down Multifamily Property Operating Expenses Across the US,” Trepp, August 2023.

- “Multifamily Fundamentals Begin To Stabilize,” CBRE, Q1 2024.

- “Affordability Challenges Prompt a House Price Slowdown,” First American Financial Corporation, 2024.

- Capital Trends, US Apartment, MSCI Real Capital Analytics, May 2024. Data as of 7/16/24.

- ”Federal Reserve issues FOMC statement,” Federal Reserve Board, June 12, 2024.

- “Apartment Transaction Volume, Sales Dip in Q1 2024,” National Apartment Association, May 2024.

- ”Quick Hits | Debt Maturities: Loan Extensions are Real,” Colliers, April 2024.

- “Construction Financing Outlook: Developers Scramble to Line Up Both Debt and Equity,” Urban Land Institute, May 2024.