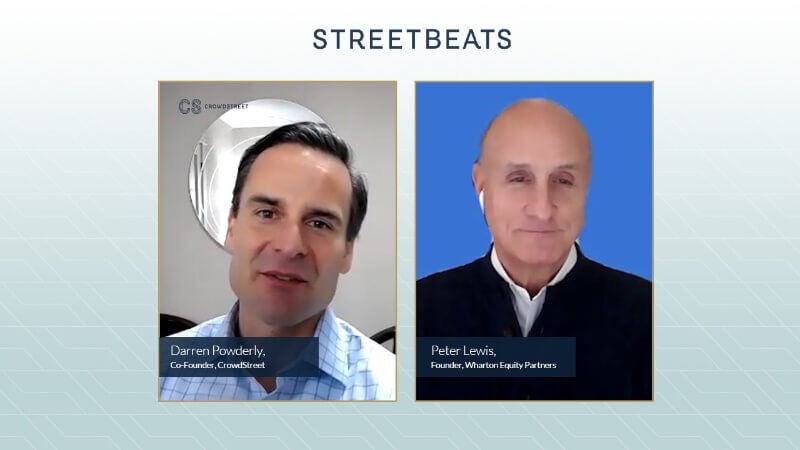

Crowd Street's Darren Powderly is joined by Peter Lewis, Founder and President of Wharton Equity Partners, to discuss the future of industrial real estate. Coming off a rather successful year in comparison to other asset classes, Darren and Peter dive into how technology is looking to improve this particular sector, how more companies will start shifting towards online business models that will require additional warehousing to aid in shipping and what both investors and sponsors should keep in mind when evaluating industrial.