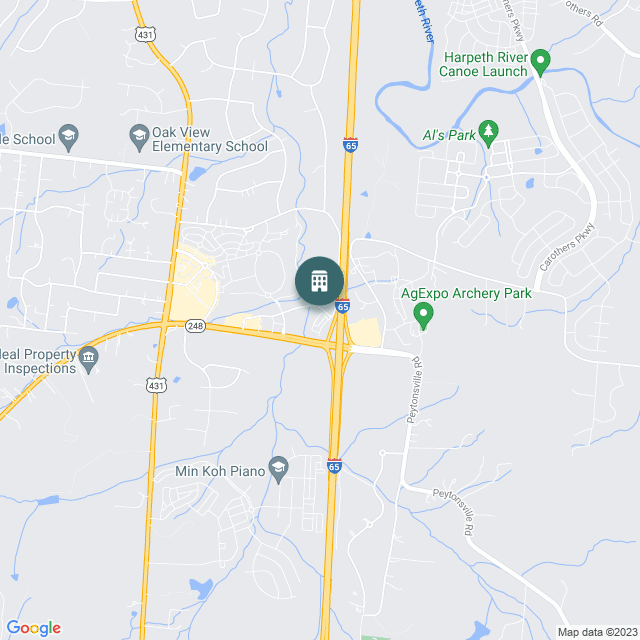

Go Store It Nashville

Class A self-storage development in one of Nashville's fastest growing suburbs with constrained supply and a high barrier to entry.

There is a reason Investopedia has named us Best Overall Real Estate Crowdfunding Platform three years in a row.

Sponsor Details

CrowdStreet categorizes sponsors based on their experience and track record so our investors can get a sense of the firm behind the deal.

|

|

Sponsor Equity

$2,443,544.00

9.67580211984751%

Investor Equity

$7,330,631.00

29.027402399801222%

Senior Loan Amount

$15,480,000

61.29679548035127%

|

|

|

Total

$25,254,175

100%

|

||

On the CrowdStreet platform, offerings are treated pari-passu. |

||

Current Investment Opportunities

Compare and review real estate projects to find the right direct investment opportunity for you. View a deal’s financial documents, watch a webinar hosted by the sponsor behind the deal, submit your investment offers, and more–all online.

Additional Resources for Self-Storage Real Estate Investors

- Read more on How CrowdStreet Advisors is evaluating self-storage real estate investing in 2025

- Learn more about the deal review process each offering goes through before being listed on the CrowdStreet platform

- Commercial Real Estate Investing Basics

- The Definitive Guide to Commercial Real Estate Property Types

Start your real estate investing journey

Build a real estate portfolio that helps you meet your investment goals.